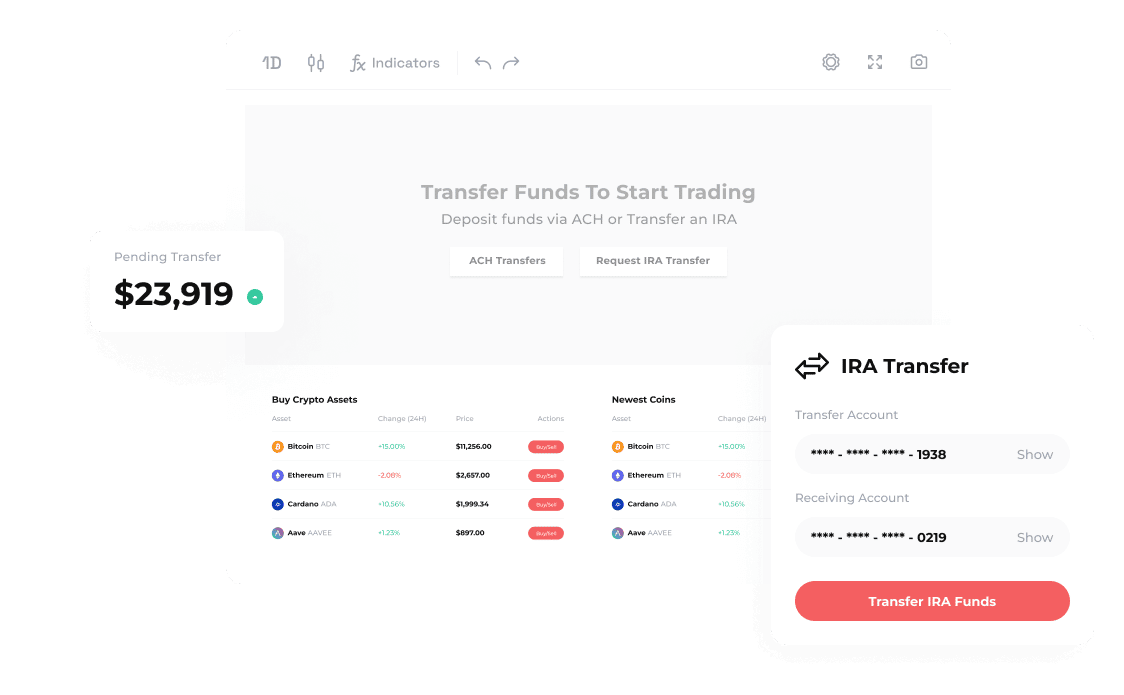

How An IRA Transfer Works

Transferring Your Existing IRA Is Fast & Easy

Once you’ve created your account on My Digital Money, our customer success team starts the account setup process. Once you’ve provided us with the details of your existing IRA, we can take everything from there. We will contact your current custodian to start the process and handle any required paperwork and communications.