How A Crypto 401(k) Rollover Works

Diversify Your Portfolio by Converting Your 401(k) To A Crypto IRA

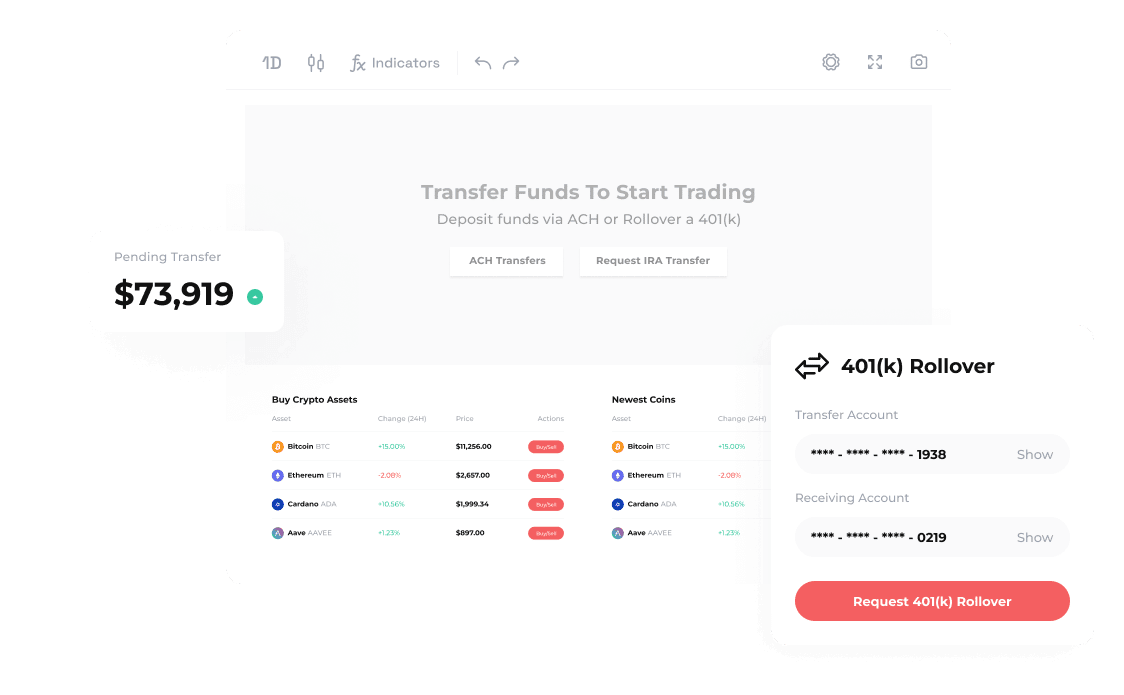

The process to rollover a 401(k) to cryptocurrency works slightly differently than transferring an IRA. Unlike an IRA transfer, only you can request a 401(k) crypto IRA rollover from your current administrator. We will give you instructions on starting the process and help with any required paperwork or documentation requested.