Built By Experienced Crypto Investors, Designed For Every Investor

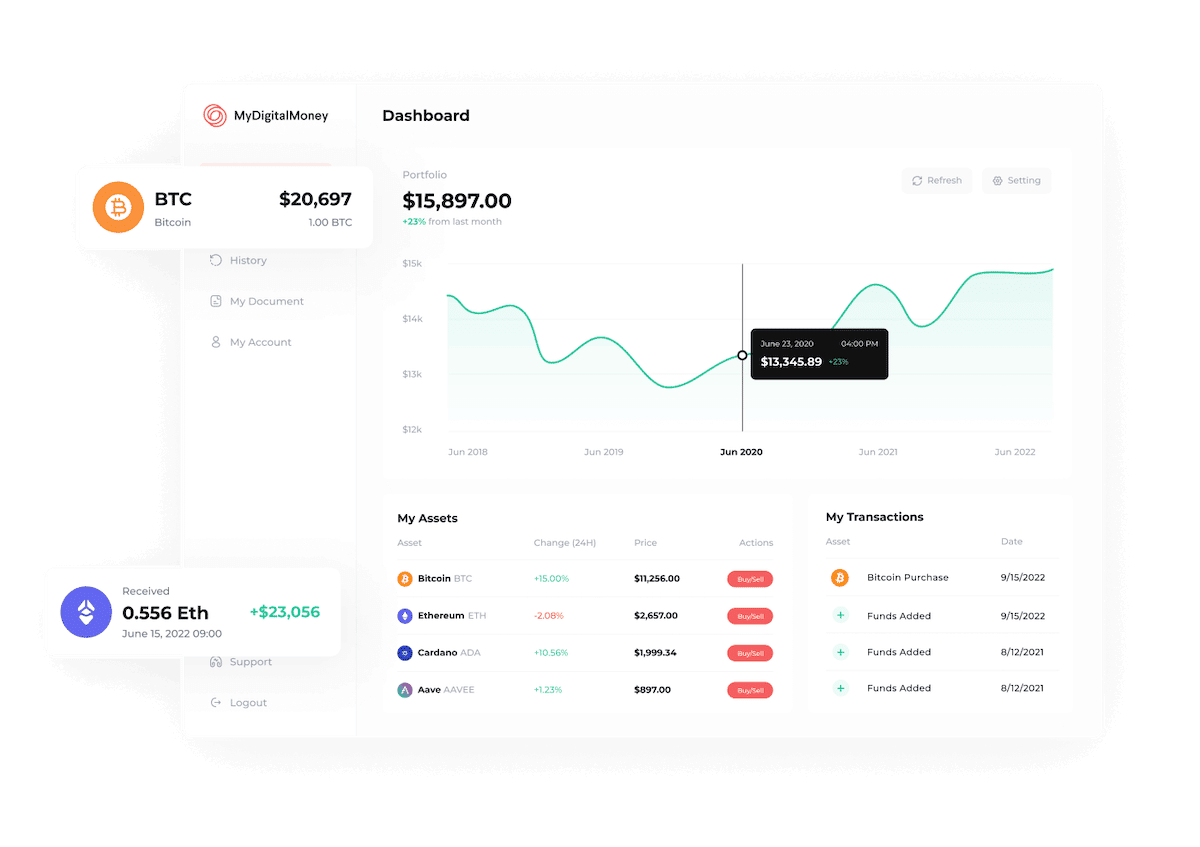

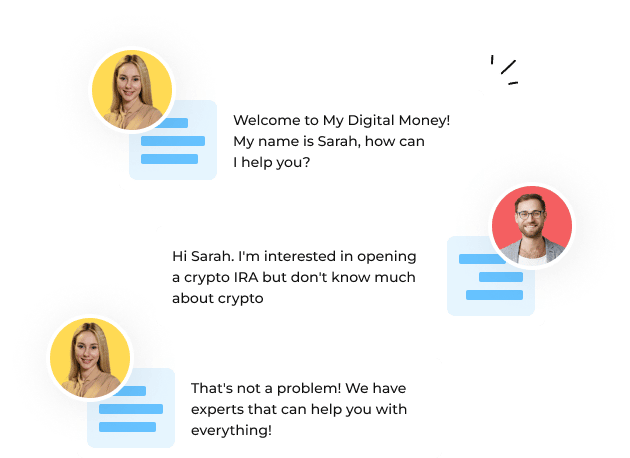

Other crypto IRA platforms can make trading complicated. My Digital Money humanizes the crypto trading experience by combining an easy-to-use user interface with helpful U.S.-based phone support.