How Does Stop Loss Crypto Trading Work

Investors on My Digital Money can take advantage of our simple crypto stop loss feature to minimize any unacceptable or unexpected losses in their crypto IRA or brokerage account.

Our Automatic Trigger Orders feature makes it easy to automate your crypto trades so that you never miss out on an opportunity. Whether you’re looking to automate selling to avoid potential losses, or automate buying to maximize potential gains, you can easily streamline your crypto trading on My Digital Money.

Investors on My Digital Money can take advantage of our simple crypto stop loss feature to minimize any unacceptable or unexpected losses in their crypto IRA or brokerage account.

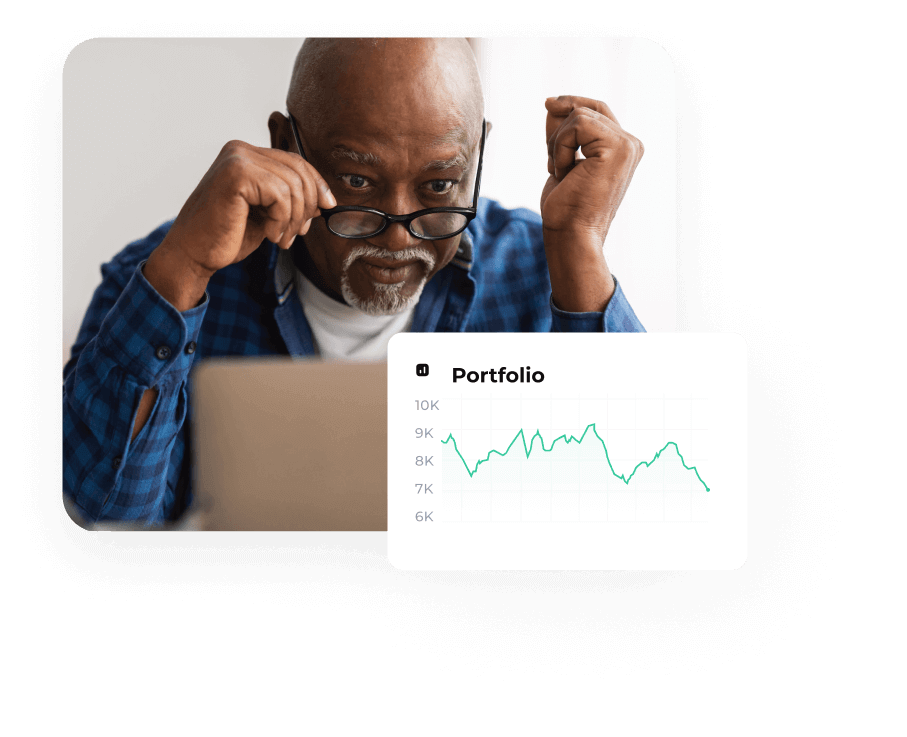

At the end of the day, if you are going to be a successful crypto trader, you have to be confident in your investment strategy. Crypto trading automation features allow investors to stick to their trade strategies, even when they’re not watching the markets.

Automatic Trigger Orders allow you to limit your potential losses based on your loss tolerance. For example, let’s say you’ve invested in a currency at $1.50 per coin. You may feel that if that coin drops by $.25 or more, it’s no longer worth holding in your portfolio. Triggering an automatic sale of that asset as it hits the price let’s you exit while your losses are still acceptable.

Investing in cryptocurrency is just like investing in any other security – it requires research, strategy, and a little bit of luck. Get started on your crypto investing journey with our free crypto guide.

Automating crypto orders is an excellent way to reduce your average cost per coin. The idea behind this strategy, known as “Averaging Down”, is to buy whenever the price is lower than the one you previously paid, bringing the overall average price you’ve paid down. This is also known as “buying the dip” and is a long-term strategy many investors use.

Automatic trigger orders allow investors to maximize their gains by ensuring they take advantage of an opportunity at a price they’ve deemed optimal. If your assumptions about price movements are correct, you can maximize your profits and bring down your average cost per coin. But if your assumptions are incorrect, it could result in a negative impact on profitability.